Preferred Stock Tax Treatment

Preferred stock tax treatment. The first of these tests under subsection b1 is that the redemption is not essentially equivalent to a dividend. BOSTON -- BUSINESS WIRE--Jan. On the day you purchase shares of preferred stock theres no taxation but your basis in the stock is established at this time.

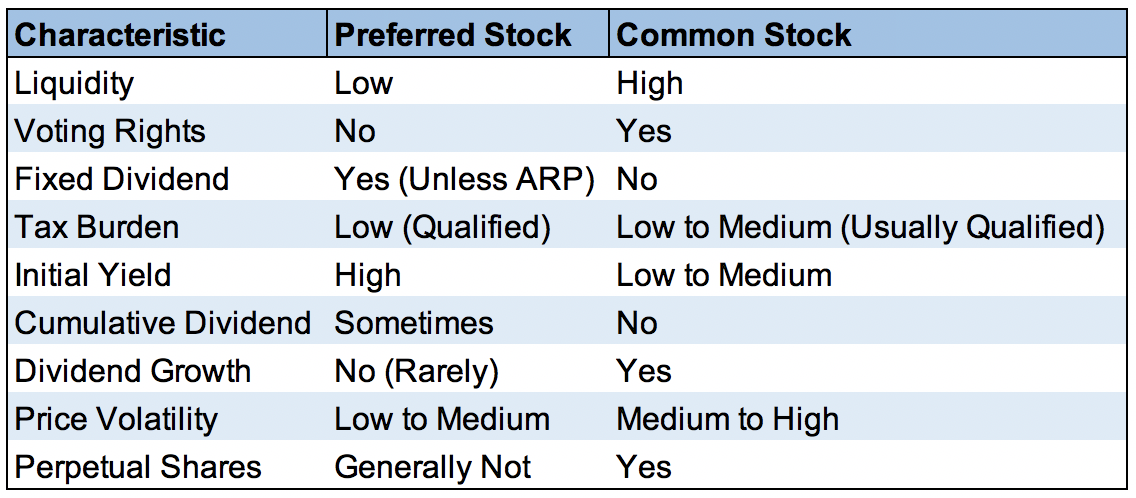

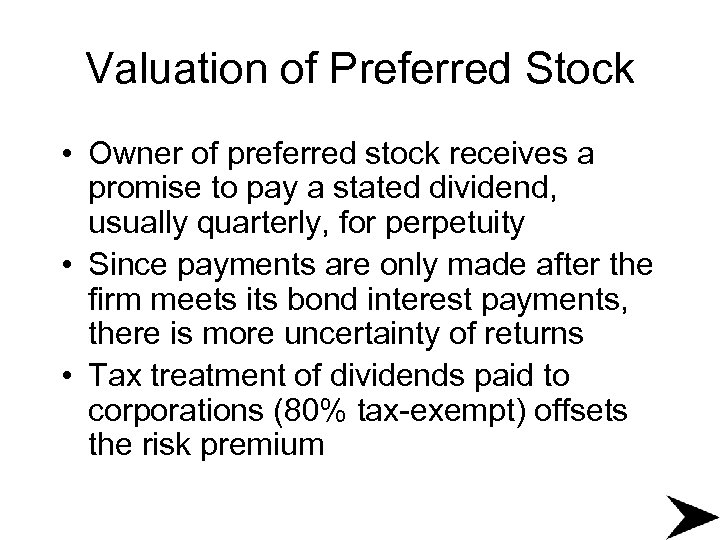

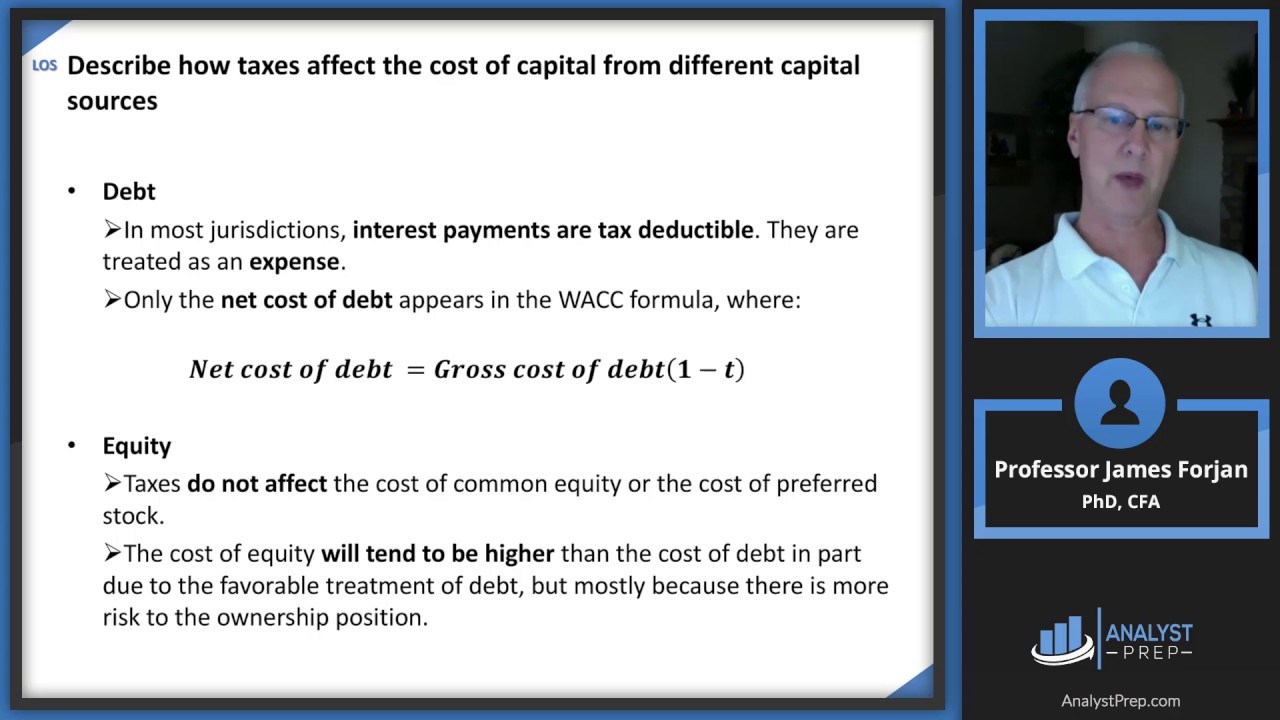

This means that their dividends are taxed at the dividend tax rate not as ordinary income. Company must exhibit a normal corporate structure and trade on any one of the major US. Preferred stock dividends are taxed differently than other assets.

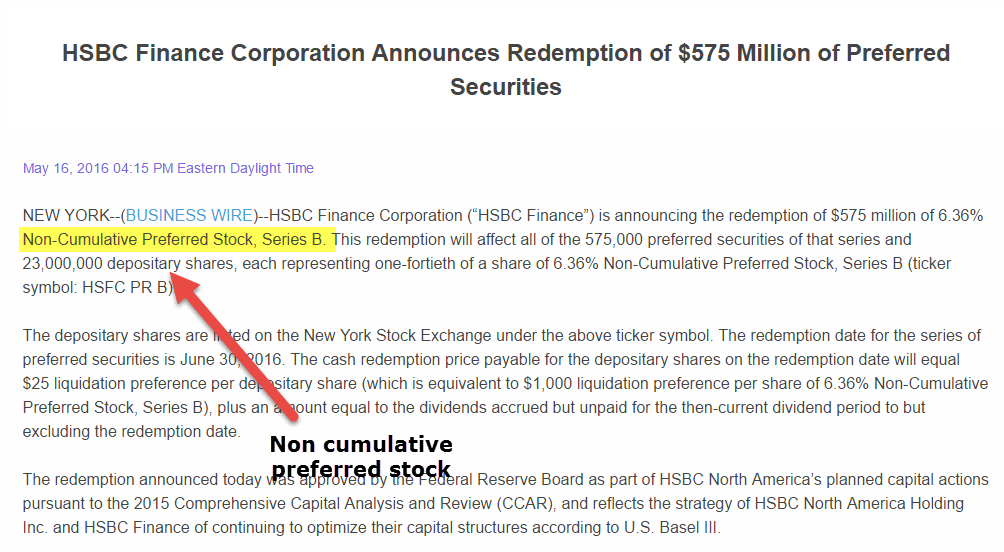

Preferreds can offer this due to the fact that many of them qualify as being QDI1-eligible. Some preferred stock dividends are not qualified. In order to be qualified a US.

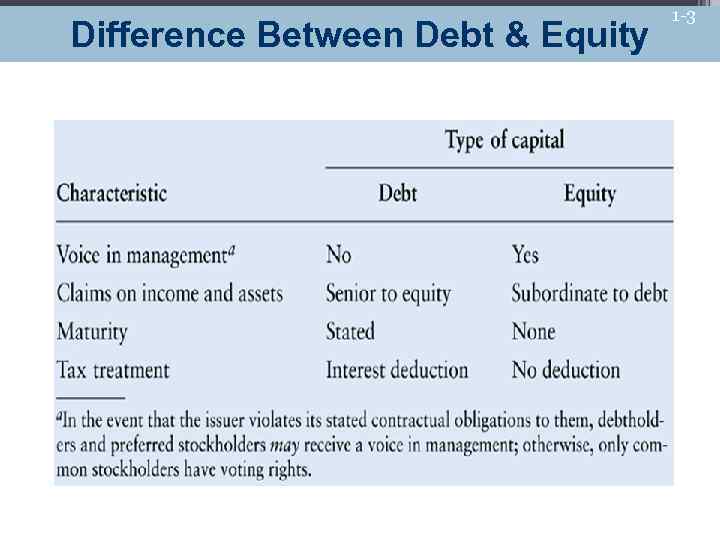

Tax Treatment of Dividends US. Corporations receive favorable tax treatment on the dividends of preferred stock with the vast majority of the dividend not subject to taxes. 19 2021-- Boston Properties Inc.

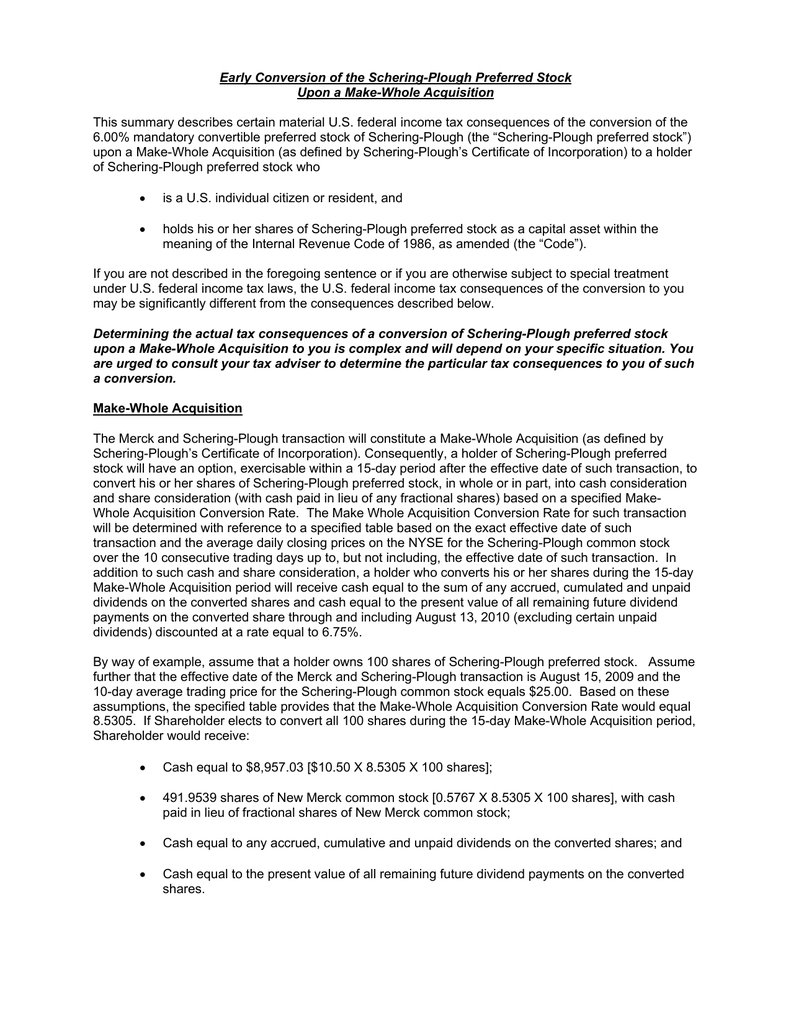

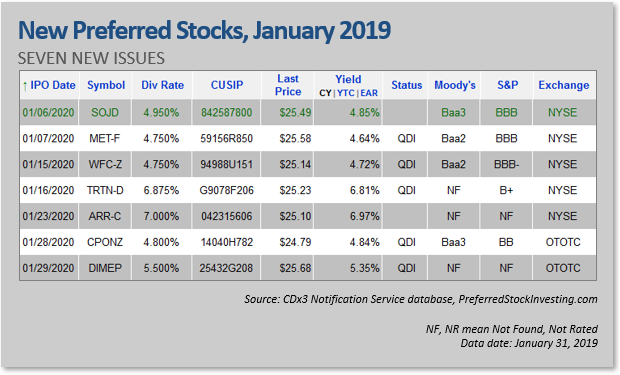

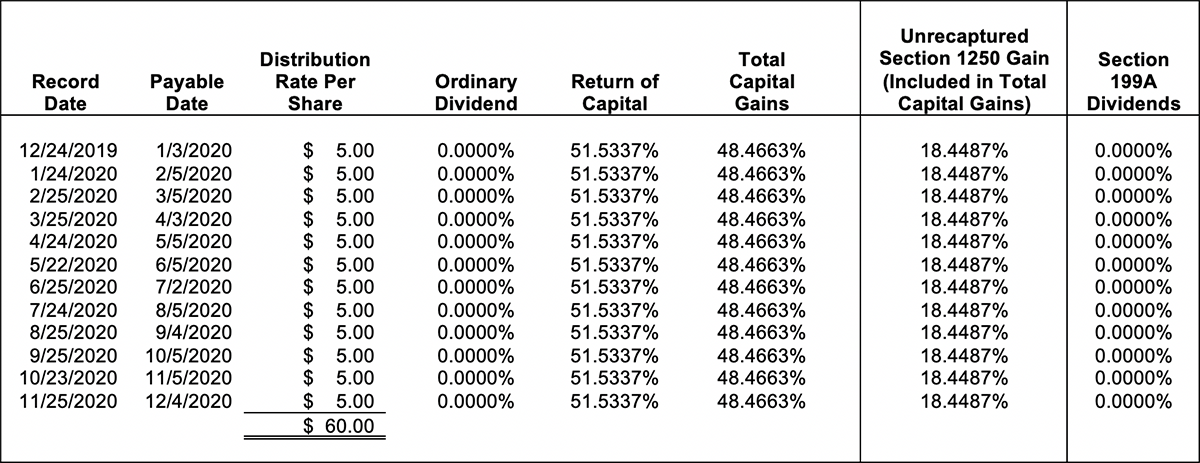

302 affords a shareholder the advantage of sale or exchange capital gain transaction treatment on redeemed stock but only if the redemption meets one of several tests. Common share and preferred share distributions paid to US. The following table summarizes the tax treatment for the 2020 common stock distributions.

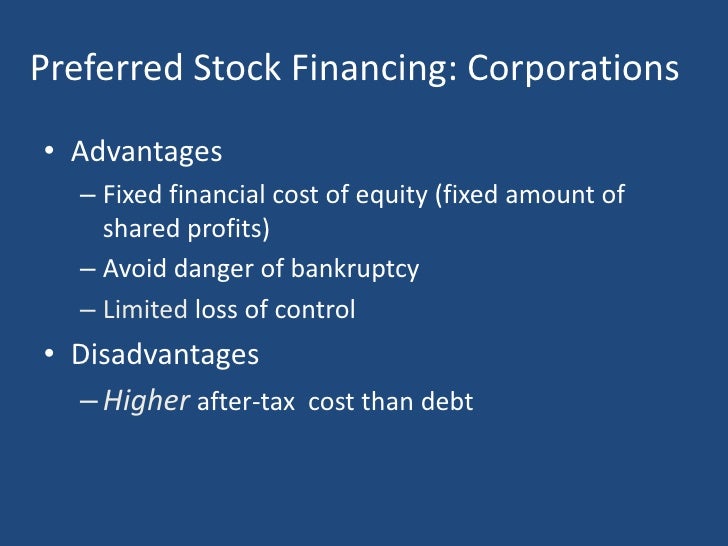

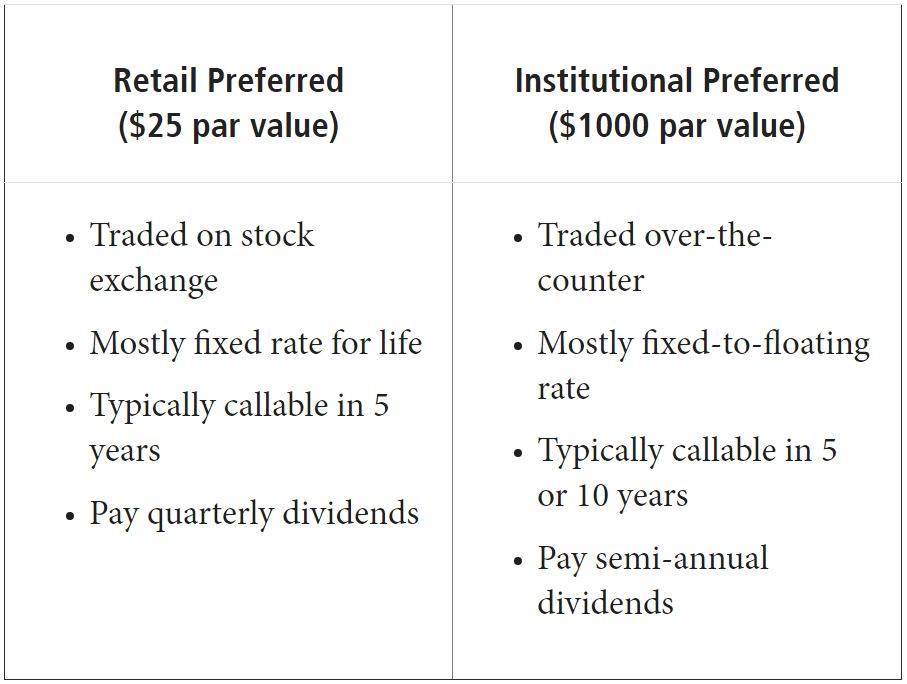

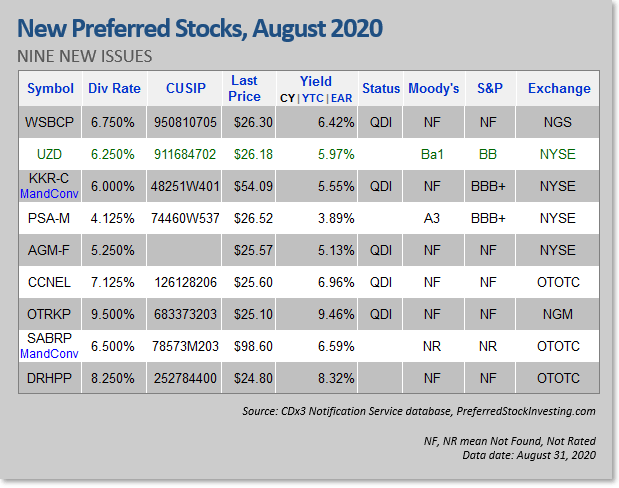

750 Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock Series A Dividends During 2020 taxable dividends for New Residentials Series A preferred stock CUSIP 64828T300 were approximately 187500 per share. There is no direct tax advantage to the issuing of. Most preferred stock dividends are treated as qualified dividends meaning they are taxed at the more favorable rate of long-term capital gains.

As of 2020 the tax rate ranges from 0 to 20 depending on your tax bracket. This reporting complies in aggregate with US.

Corporations that are subject to corporate income tax are generally allowed to exclude 70percent of the dividend income they receive from their taxable income.

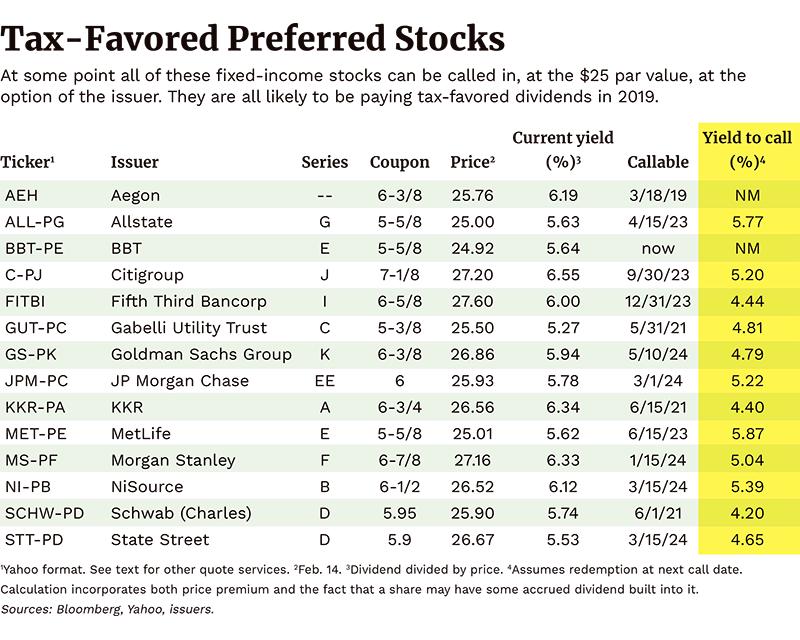

750 Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock Series A Dividends During 2020 taxable dividends for New Residentials Series A preferred stock CUSIP 64828T300 were approximately 187500 per share. The first of these tests under subsection b1 is that the redemption is not essentially equivalent to a dividend. This reporting complies in aggregate with US. Corporations receive favorable tax treatment on the dividends of preferred stock with the vast majority of the dividend not subject to taxes. 19 2021-- Boston Properties Inc. The Companys dividend distributions per share of 7875 Series E Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock CUSIP 649604873 are. There is no direct tax advantage to the issuing of. While the ten tax-advantaged preferred stocks listed in the above table offer the special 15 tax treatment to risk-averse preferred stock investors you give up about 19 of. The following table summarizes the tax treatment for the 2020 common stock distributions.

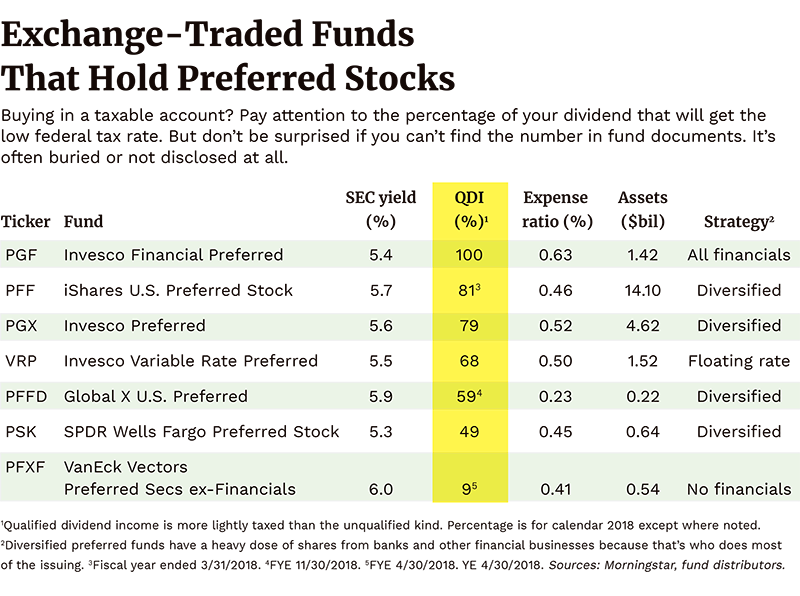

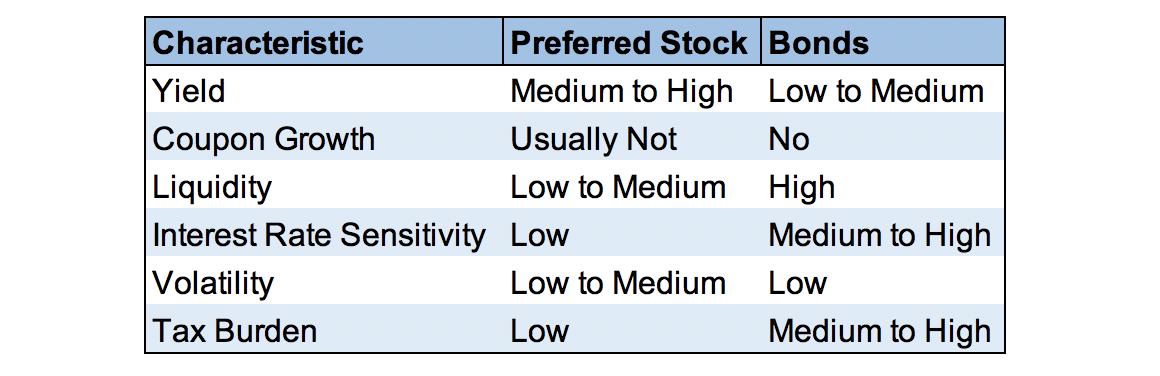

When they are qualified they incur lower taxation than even regular income. Because of the favorable tax treatment of the preferred stock dividends. Allow for a 15 federal tax relevant to most of the people reading this paragraph plus a 38 surcharge for the ones with income over 250000 and youre left with 4 and a fraction. In order to be qualified a US. STOCKS THAT ACT LIKE BONDS. While the ten tax-advantaged preferred stocks listed in the above table offer the special 15 tax treatment to risk-averse preferred stock investors you give up about 19 of. Preferreds can offer this due to the fact that many of them qualify as being QDI1-eligible.

/stock_certificates-5bfc321a4cedfd0026c24c0c.jpg)

/thinkstockphotos-144229773-5bfc2b3f46e0fb0083c06edd.jpg)

Posting Komentar untuk "Preferred Stock Tax Treatment"